Summary: Medicare penalties occur when you wait to sign up for coverage. These penalties, called late enrollment penalties, can have a significant impact on your monthly premiums. In this article, we’ll explain how Medicare penalties work, how they affect your premiums, and what you can do to avoid them.. Estimated Read Time: 9 min

What is a Medicare Late Enrollment Penalty?

There are many reasons why you should enroll in Medicare coverage as soon as you become eligible and late enrollment penalties are one of them. A Medicare late enrollment penalty is an additional cost that is added to your monthly premiums when you delay Medicare benefits without creditable coverage.

Late enrollment penalties are not one-time penalties and typically continue for as long as you have the type of coverage that you’re being penalized for. For example, if you have a Medicare Part B penalty, then you will pay that penalty as long as you have Part B coverage.

Luckily, Medicare late enrollment penalties are easy to avoid. Below, we’ll explain how each penalty works, how much you could end up paying, and how to avoid getting a penalty in the first place.

Why Does Medicare Have Late Enrollment Penalties?

If you’re wondering “why does Medicare have penalties for late enrollment?”, you’re not alone. Many people are surprised to find out that Medicare has penalties that can last for as long as you have coverage. To understand why Medicare has penalties, you first need to understand how Medicare is funded.

Medicare Part A is largely funded by payroll taxes paid by employees and employers. This is why Medicare Part A has a $0 premium for people who paid Medicare taxes for at least 10 years, or 40 quarters. This is also why individuals who did not work the appropriate amount of time have to “buy in” to Medicare Part A and pay a monthly premium.

Medicare Part B and Medicare Part D are funded by a combination of funds authorized by Congress and premiums paid by people who are enrolled in Part B and/or Part D. Like other health insurance plans, monthly premiums paid by healthy individuals help offset the cost of coverage for individuals who have more healthcare needs. This helps ensure Medicare has enough funds to provide the appropriate care when it is needed.

Late enrollment penalties help incentivize healthy individuals to enroll in coverage when they first become eligible. Otherwise, people may wait until they’re sick or in need of their benefits to enroll. This would cause Medicare to deplete its funds faster than they are accrued.

Additionally, when you enroll in Original Medicare, you receive coverage for many preventative services. Early detection and preventative measures can help reduce the risk (and cost) of serious health conditions.

Medicare Part A Penalty

As mentioned above, most people qualify for a $0 premium Medicare Part A due to paying Medicare taxes throughout their time in the workforce. Because of this, most people apply for Medicare Part A as soon as they become eligible for Medicare coverage. If you do qualify for a $0 premium for Medicare Part A, then you do not have to worry about a Medicare Part A late enrollment penalty, even if you choose to sign up outside of your Initial Enrollment Period.

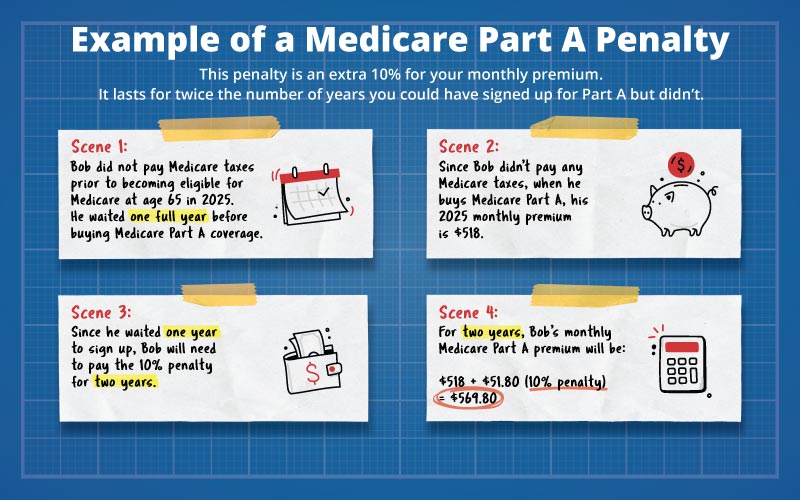

For those who do not qualify for the $0 premium, you will need to “buy” Medicare Part A. When you buy Medicare Part A, you will need to pay a monthly premium of either $285 or $518 in 2025, depending on how long you paid Medicare taxes. If you do not buy Medicare Part A when you are first eligible, you will be required to pay a late enrollment penalty. This penalty is an extra 10% for your monthly premium, which lasts for twice the number of years you could have signed up for Part A but didn’t. Let’s look at an example:

You did not pay Medicare taxes prior to becoming eligible for Medicare at age 65 in 2023. You waited a full year before buying Medicare Part A coverage. Because you didn’t pay any Medicare taxes, your 2024 monthly premium for Part A is $505.

Since you waited a year to sign up, you will need to pay the 10% penalty for two years. So for two years, your monthly Medicare Part A premium would be $505 + $50.50 (10% penalty) = $555.50.

Medicare Part A Penalty Calculator

Medicare Part B Penalty

Unlike Medicare Part A, everyone who enrolls in Medicare Part B must pay a monthly premium; because of this, some individuals may want to delay applying for Medicare Part B. However, it’s important to understand that if you delay getting Medicare Part B coverage and you don’t have creditable coverage in place, you could face a Medicare Part B late enrollment penalty.

To avoid the Medicare Part B penalty, you must enroll in Part B coverage during your Initial Enrollment Period, or during a qualifying Special Enrollment Period. Commonly, individuals who become eligible for Medicare while still working will wait to sign up for Medicare Part B until they no longer have creditable health insurance through their employer. If you are still working, and your employer has more than 20 employees, your health insurance is considered creditable. As long as you have creditable coverage, you will not be subject to the Part B penalty if you wait to enroll.

How long does the Medicare Part B penalty last? Your Medicare Part B penalty will remain for as long as you have Part B coverage. For most, this means it is a lifetime penalty. Not only will this penalty remain for as long as you have coverage, but since the Medicare Part B premium increases most years, your penalty will also increase.

Medicare Part B Penalty Calculator

If you do not enroll in Medicare Part B when you first become eligible, and you don’t have other creditable coverage, you may face a late enrollment penalty. The penalty is added to your monthly premium.

How to Calculate the Medicare Part B Late Enrollment Penalty

If you were eligible for Medicare Part B but didn’t sign up, you will pay an extra 10% for your monthly premium for each year you chose not to sign up. Let’s look at an example.

You became eligible for Medicare Part B in April of 2021. You did not have creditable coverage and chose to wait until April of 2024 to enroll. Since you waited three full years, you will be subject to a 30% penalty.

The standard premium for Medicare Part B in 2024 is $174.70. Since you have a 30% late enrollment penalty, your monthly premium will be the standard monthly premium ($174.70) plus 30% of $174.70.

2024 Standard Premium ($174.70) + 30% Penalty ($52.41) = $227.11

By waiting three full years to sign up for Medicare Part B, your monthly premium with the penalty included would be $227.10 (amount is rounded to the nearest $0.10).

As you can see above, the Medicare Part B penalty can have a significant impact on your monthly Medicare costs. It’s imperative that you understand when to sign up for Medicare coverage to ensure you don’t incur a penalty.

Medicare Part D Penalty

Since some individuals are automatically enrolled in Medicare Part A and Medicare Part B once they become eligible for Medicare, the Part B penalty can be easy to avoid. The Medicare Part D penalty, however, can catch some people by surprise.

It’s imperative that you get Medicare drug coverage as soon as you become eligible to avoid the Medicare Part D late enrollment penalty. You can get your drug coverage either through a standalone Medicare Prescription Drug Plan (PDP) or through a Medicare Advantage plan with prescription drug coverage (MAPD plan).

There are exceptions: you will not be penalized if you have creditable drug coverage through you or your spouse’s employer. Once your group insurance ends, you will receive a Special Enrollment Period in which you can apply for a Medicare Part D Prescription Drug plan. You will also not receive the Medicare Part D penalty if you qualify for the Medicare Part D low-income subsidy known as Extra Help.

How long does the Medicare Part D penalty last? Like the Medicare Part B penalty, the Medicare Part D penalty will last for as long as you have Medicare drug coverage. For some, this may mean a lifetime penalty. If you apply for Extra Help, you will not need to pay your Medicare Part D penalty while you are receiving Extra Help.

Medicare Part D Penalty Calculator

If you do not enroll in Medicare Part D when you first become eligible, and you don’t have other creditable drug coverage, you may face a late enrollment penalty.

How to Calculate the Medicare Part D Late Enrollment Penalty

If you are subject to the Medicare Part D penalty, you will be required to pay an extra 1% of the national base beneficiary premium for each month you go without creditable drug coverage, in addition to your plan’s premium. Here is an example:

Your Initial Enrollment Period ended in August, but you waited until the Annual Enrollment Period in October to sign up for a Medicare Part D Prescription Drug plan. Because you enrolled in a plan during the Annual Enrollment Period, your coverage will not go into effect until January.

Since you went four months (August-January) without drug coverage, you will receive a 4% penalty. The national base beneficiary premium for 2024 is $34.70.

4% (your penalty) of the national base beneficiary premium ($34.70) is $1.38. Rounded to the nearest $0.10, your penalty is $1.40.

The penalty fee will be added to your drug plan’s premium each month. So, if your plan has a $65.00 monthly premium, you will pay a total of $66.40 each month.

In the above example, the Medicare Part D penalty doesn’t have such a big impact on your monthly premium. However, the longer you wait to get drug coverage, the more significant your penalty will be.

Is There a Late Enrollment Penalty for Medicare Advantage Plans?

Medicare Part C differs from the other parts of Medicare in the fact that it doesn’t really matter when you choose to enroll in a Medicare Advantage plan. If you are eligible for Medicare Part C and sign up for a plan during a valid enrollment period, there is no penalty for waiting to enroll. You can have Original Medicare for five years before deciding to sign up for a Medicare Advantage plan with no penalties.

However, keep in mind that if you wait to sign up for a Medicare Advantage plan that includes drug coverage, and you do not have creditable coverage in the meantime, you may incur the Medicare Part D penalty.

Is There a Late Enrollment Penalty for Medicare Supplement Plans?

Though Medicare Supplement plans don’t have late enrollment penalties like Medicare Part B or Part D, enrolling in a Medigap plan outside of your Medicare Supplement Open Enrollment Period can have negative consequences.

- You will most likely have to undergo medical underwriting. Your plan may ask you questions about current and previous health conditions; they may also ask about which prescription drugs you take.

- Outside of your Medicare Supplement Open Enrollment Period, a plan can deny your application due to the answers on your medical underwriting.

- After reviewing your answers, a plan may choose to accept your application, but charge you a higher premium due to existing health conditions.

You may qualify for guaranteed issue rights during a Special Enrollment period if you meet certain requirements. If you do, you can enroll in a Medicare Supplement plan without medical underwriting.

Though medical underwriting won’t have a negative effect on everyone, it’s important to understand that waiting to enroll in a Medicare Supplement plan can result in declined applications and higher premiums.

How to Avoid Medicare Penalties

The best way to avoid Medicare penalties is with knowledge and proper preparation. Understanding how Medicare enrollment periods work can help ensure you sign up for coverage at the right time. Make sure you start getting together the documentation you need for applying for Medicare ahead of time, so you are ready for the application process. For drug coverage, consider finding and comparing plans a few days before you are eligible to enroll. Depending on your healthcare needs, finding a plan that works best for you may take some time.

Sources

How is Medicare Funded? Medicare.gov. Accessed December 2023

https://www.medicare.gov/about-us/how-is-medicare-funded

Avoid Late Enrollment Penalties, Medicare.gov. Accessed December 2023

https://www.medicare.gov/basics/costs/medicare-costs/avoid-penalties

Medicare & You 2024, Medicare.gov. Accessed December 2023

https://www.medicare.gov/publications/10050-Medicare-and-You.pdf