Summary: Though most doctors in the U.S. accept Medicare, some do not accept Medicare Assignment. This means you’ll be responsible for the additional costs, also known as excess charges. In this article, we’ll give you the necessary information for understanding and avoiding Medicare Part B excess charges. Estimated Read Time: 5 min

What are Medicare Part B Excess Charges?

When a health care provider participates in Medicare, they can choose whether or not they want to accept Medicare assignment. Accepting assignment means your doctor accepts the Medicare-approved amount for their services.

Providers who do not accept assignment can bill you up to 15% over the Medicare-approved amount. This additional out-of-pocket cost is known as an excess charge. Though excess charges vary from provider to provider, they cannot exceed the Medicare limiting charge.

The Medicare limiting charge is the maximum amount a health care provider can charge you for a service that is covered by Original Medicare. Federally, the limiting charge is 15% over Medicare’s approved amount. Providers who do not accept assignment do not have to charge the maximum amount in excess charges. For example, some providers may only charge 5% or 10% over the Medicare-approved amount.

Medicare Part B excess charges are covered by some Medicare Supplement Plans (Medigap). Medigap plans provide coverage for “gaps” in Original Medicare including copayments, deductibles, and coinsurance. There are ten standard Medicare Supplement Plans, and two high-deductible plans available.

Medigap plans F, G, and their high-deductible versions cover both your Medicare Part B coinsurance and any Part B excess charges. If you have a different Medigap plan, or are only enrolled in Original Medicare, you will need to pay for excess charges out of your own pocket.

How Common are Medicare Part B Excess Charges?

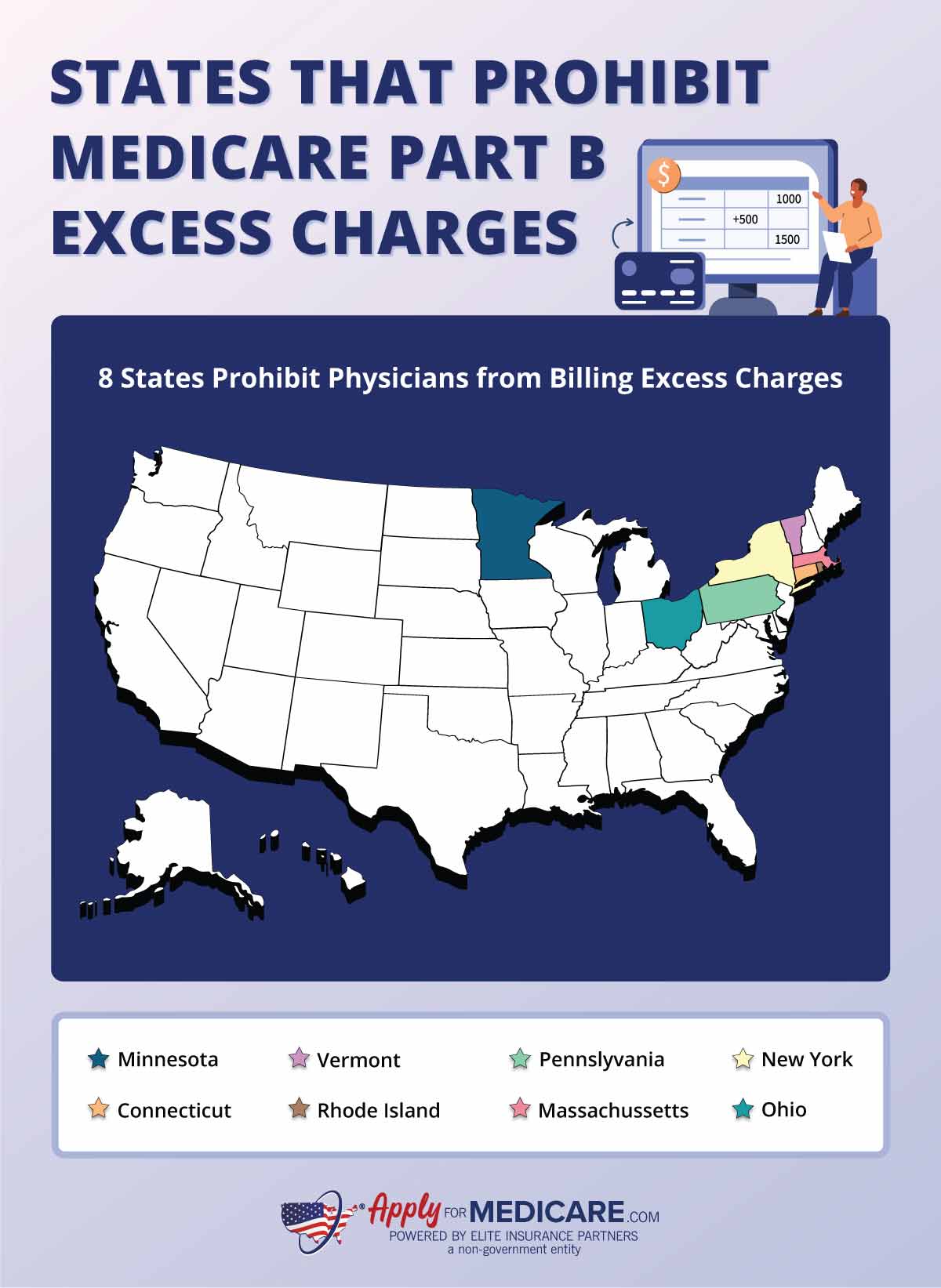

Medicare Part B excess charges are not common; in fact, over 96% of doctors in the U.S. accept Medicare and Medicare assignment. Additionally, there are eight states in the U.S. that do not allow health care providers to bill any excess charges.

Though Medicare excess charges are uncommon, you should still check with your provider before scheduling an appointment. You can also visit Medicare.gov to search for providers in your area that accept Medicare and Medicare assignment.

Which States Allow Medicare Part B Excess Charges?

Every state in the U.S. other than Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont allow Medicare Part B excess charges. If you live in a state that allows Medicare excess charges, you can find out which providers near you accept Medicare assignment by using Medicare’s Care Compare tool.

Which States Prohibit Medicare Part B Excess Charges?

There are currently eight states in the U.S. that prohibit physicians from billing excess charges.

The states that prohibit Medicare Part B excess charges are:

- Connecticut

- Massachusetts

- Minnesota

- New York

- Ohio

- Pennsylvania

- Rhode Island

- Vermont

If you’re a resident of one of the above states, it’s important to remember that if you receive care in a different state that does allow excess charges, you will be responsible for paying them. If you like to travel or have a vacation home in a state that allows excess charges, you may consider getting a Medicare Supplement plan.

Medicare Part B Excess Charge Examples

Below we have prepared some examples of Medicare Part B excess charges to illustrate how they would be billed in different situations.

Dr. Smith accepts Medicare but does not accept Medicare assignment. The cost of service you’re receiving has a Medicare allowable charge of $300. You could pay up to $45 in excess charges (15% over the Medicare-approved amount).

What if the cost of the service is more than 15% of the Medicare-approved amount? Let’s say Dr. Smith typically charges $400 for his service, but the Medicare-approved amount is only $300. The Medicare limiting charge is 15%, so regardless of how much Dr. Smith typically charges for this service, he can only bill you up to 15% in excess charges. At most, you would need to pay $45 in excess charges.

Although the Medicare limiting charge is 15%, that does not mean a provider will always charge you 15% in excess charges. If Dr. Smith’s service typically costs $330, and the Medicare-approved amount is $300, your excess charge would be $30, or 10%.

Don’t forget that Medicare Part B excess charges are paid in addition to your 20% Part B coinsurance. If you haven’t met your Medicare Part B deductible yet, you will also be responsible for paying that.

How to Avoid Medicare Part B Excess Charges

No one wants to get blindsided by additional out-of-pocket charges after receiving medical care. Fortunately, it is easy to avoid Medicare Part B excess charges by following a few simple steps:

First, contact your health care provider prior to scheduling a visit and ask if they accept Medicare patients. If a provider does not accept Medicare, then you will be responsible for paying the full cost of your service.

If your doctor does accept Medicare, you will then want to ask if they accept Medicare assignment. Remember, accepting assignment means that your doctor accepts the Medicare-approved amount as the full payment for the covered service.

If your health care provider accepts Medicare assignment, then you will not have to pay for any excess charges. You will still be responsible for your deductible and coinsurance, but you will not have any excess charges for the service.

However, if your health care provider does not accept Medicare assignment, then you may end up paying excess charges. These charges can be up to 15% over the Medicare-approved amount.

Although most doctors and other health care providers accept assignment, it’s important to check beforehand to make sure. By checking with your health care provider ahead of time, you can avoid paying more out of pocket.

Should You Worry About Medicare Part B Excess Charges?

When you’re on a budget, extra out-of-pocket costs for healthcare can be worrying. Luckily, Medicare excess charges are easy to avoid. However, in some cases, you may have no other option than to go to a physician who doesn’t accept Medicare assignment. Understanding how excess charges works can prepare you for the added out-of-pocket fees.

If you have any questions regarding Medicare assignment or Medicare excess charges, give our team a call. Our licensed agents can help answer your questions and provide additional information on how to avoid excess charges when using your Medicare Part B benefits.

Sources

Does your Provider Accept Medicare as Full Payment?, Medicare. Accessed June 2023

https://www.medicare.gov/basics/costs/medicare-costs/provider-accept-Medicare

Medicare Costs, Medicare. Accessed June 2023